4QFY2017 Result Update | IT

May 15, 2017

HCL Technologies

BUY

CMP

`847

Performance Highlights

Target Price

`1,014

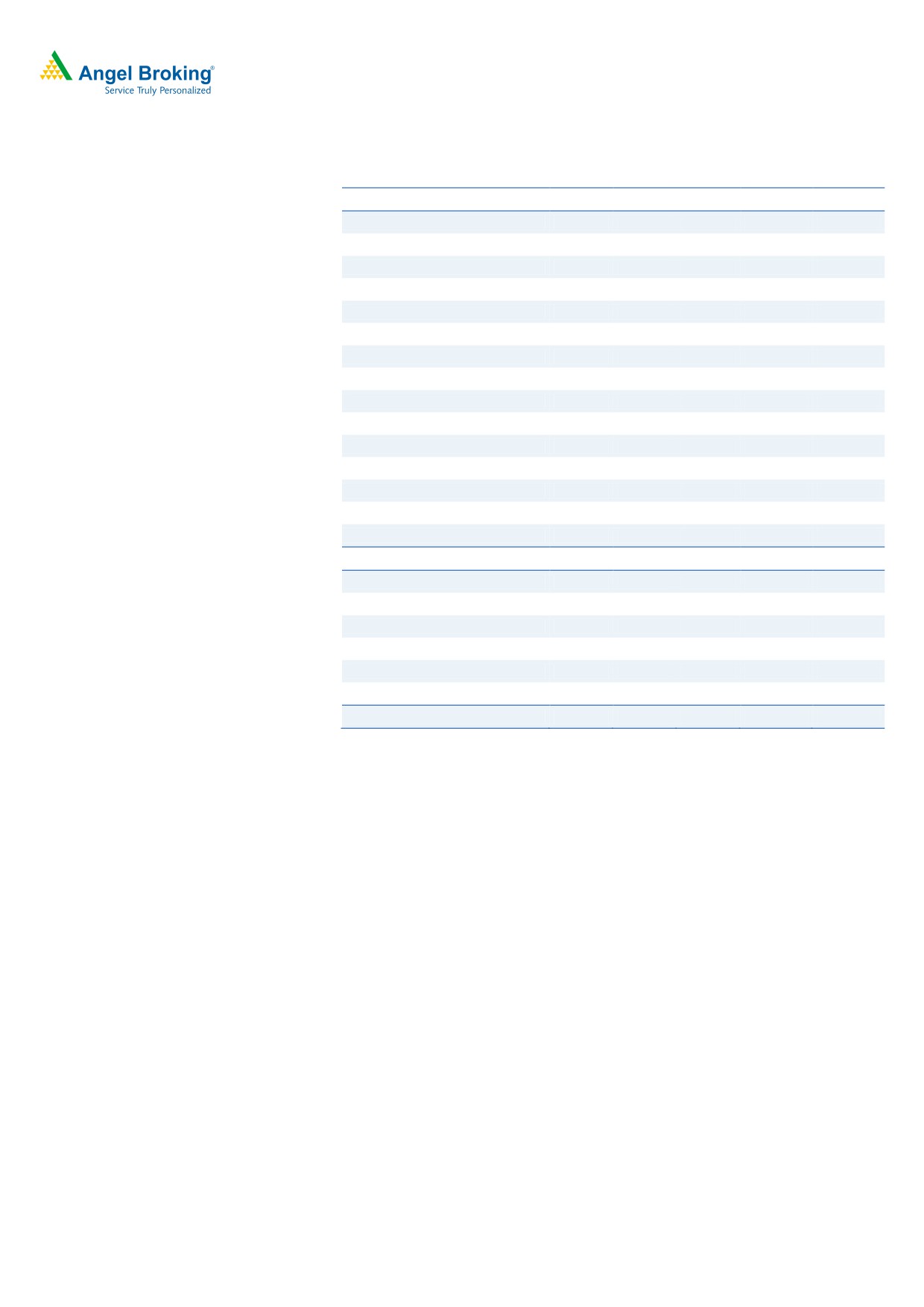

(` cr) - Consl.

4QFY17

3QFY17

% chg (qoq)

4QFY16

% chg (yoy)

Investment Period

12 Months

Net revenue

12,053

11,814

2.0

10,698

12.7

Stock Info

EBIT

2,416

2,408

0.3

2,222

8.7

EBIT margin (%)

20.0

20.4

(34)bp

20.8

(73)ps

Sector

IT

PAT

2,325

2,070

12.3

1,926

20.7

Market Cap (` cr)

1,20,898

Source: Company, Angel Research

Net Debt (` cr)

(12140)'

Beta

0.4

The company posted 4QFY2017 results better than expected. In US$ terms, the

52 Week High / Low

890/707

revenues came in at US$1,817mn (v/s US$1,810mn expected) v/s US$1,745mn

Avg. Daily Volume

37,534

in 3QFY2017, a qoq growth of

4.1%. On Constant Currency (CC) basis,

Face Value (`)

2

company posted a 3.8% qoq growth. On the operating front, EBIT came in at

BSE Sensex

30,188

20.0% (v/s 20.1% expected) v/s 20.4% in 3QFY2017, a dip of 34bps qoq. Thus,

Nifty

9,401

PAT came in at 2,325cr (v/s `1,982cr expected) v/s `2,070cr in 3QFY2017, up

12.3% qoq. For FY'2018, revenues are expected to grow 10.5-12.5% in Constant

Reuters Code

HCLT.BO

Currency (CC) and EBIT Margin of 19.5-20.5%. We maintain our buy.

Bloomberg Code

HCLT@IN

Quarterly highlights: In US$ terms, the revenues came in at US$1,817mn v/s

US$1,745mn in 3QFY2017, a qoq growth of 4.1%. On Constant Currency (CC)

Shareholding Pattern (%)

basis, company posted a 3.8% qoq growth. On the growth front, USA posted a

Promoters

59.7

CC qoq growth of 5.3%, Europe posted a dip of 3.0% CC and ROW posted a CC

MF / Banks / Indian Fls

11.8

qoq growth of 15.8%. In terms of verticals, Financial Services posted a CC qoq

FII / NRIs / OCBs

25.1

growth of 3.0%, Manufacturing posted a CC qoq growth of 6.3%, Life sciences &

Indian Public / Others

3.5

Healthcare posted a CC qoq growth of 0.1%, Public Services posted a CC qoq

growth of 8.1%, while Retail & CPG posted a CC qoq growth of 2.1%. On the

operating front, EBIT came in at 20% (v/s 20.1% expected) v/s 20.4% in

Abs.(%)

3m

1yr

3yr

3QFY2017, a dip of 34bps qoq. Thus, PAT came in at 2,325cr (v/s `1,982cr

Sensex

6.5

17.1

28.2

expected) v/s `2,070cr in 3QFY2017, up 12.3% qoq.

HCL Tech

2.5

18.3

21.9

Outlook and valuation: We expect HCL Tech to post a USD and INR revenue

CAGR of 10.7% and 10.7% respectively over FY2017-19E. On the back of strong

order book and given the attractive valuations, we recommend a Buy on the stock.

3-year price chart

Key financials (Consolidated, US GAAP)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

Net sales

30,781

46,723

52,342

57,053

% chg

(16.9)

51.8

12.0

9.0

Net profit

5,643

8,457

8,860

9,536

% chg

(22.2)

49.9

4.8

7.6

EBITDA margin (%)

21.5

22.1

20.9

20.9

EPS (`)

40.0

60.0

62.8

67.6

P/E (x)

21.2

14.1

13.5

12.5

P/BV (x)

4.3

3.6

3.0

2.6

Source: Company, Angel Research

RoE (%)

20.1

25.3

22.4

20.6

Sarabjit kour Nangra

RoCE (%)

15.6

20.4

18.3

17.3

+91 22 3935 7800 Ext: 6806

EV/Sales (x)

3.6

2.3

2.0

1.7

EV/EBITDA (x)

16.6

10.5

9.5

8.2

Source: Company, Angel Research; Note: CMP as of May 12, 2017

Please refer to important disclosures at the end of this report

1

HCL Technologies | 4QFY2017 Result Update

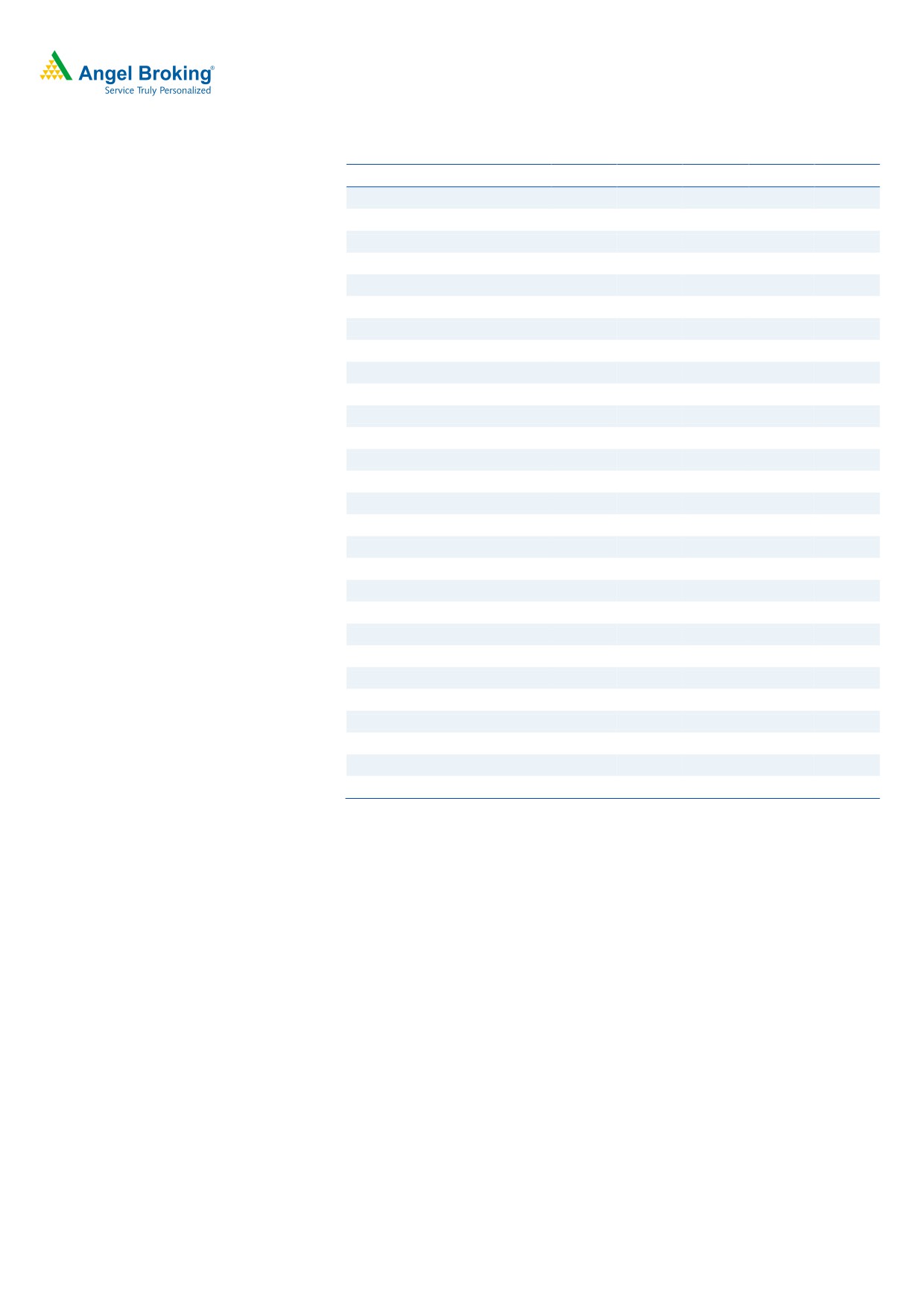

Exhibit 1: 4QFY2017 performance (Consolidated, US GAAP)

Y/E March (` cr)

4QFY17

3QFY17

% chg (qoq)

4QFY16

% chg (yoy)

FY17

FY16

% chg(yoy)

Net revenue

12,053

11,814

2.0

10,698

12.7

46,723

40,913

14.2

Cost of revenue

7,987

7,809

2.3

6,961

14.7

30,890

26,901

14.8

Gross profit

4,066

4,005

1.5

3,737

8.8

15,833

14,012

13.0

SG&A expense

1,417

1,377

2.9

1,358

4.3

5,524

5,217

5.9

EBITDA

2,649

2,628

0.8

2,379

11.3

10,309

8,795

17.2

Dep. and

233

220

5.9

157

48.4

835

569

46.7

amortization

EBIT

2,416

2,408

0.3

2,222

8.7

9,474

8,226

15.2

Other income

215

231

(6.9)

200

7.5

934

1,009

(7.4)

PBT

2,631

2,639

(0.3)

2,422

8.6

10,408

9,235

12.7

Income tax

303

568

(46.7)

497

(39.0)

1,952

1,883

3.7

PAT

2,325

2,070

12.3

1,926

20.7

8,456

7,352

15.0

Forex gain/(loss)

-

-

-

-

-

-

Adjusted PAT

2,325

2,070

12.3

1,926

20.7

8,456

7,352

15.0

EPS

16.5

14.7

12.3

13.7

20.7

60.0

52.1

15.0

Gross margin (%)

33.7

33.9

(17)bp

34.9

(120)bps

33.9

34.2

(36)bp

EBITDA margin (%)

22.0

22.2

(27)bp

22.2

(26)bps

22.1

21.5

57bp

EBIT margin (%)

20.0

20.4

(34)bp

20.8

(73)ps

20.3

20.1

17bp

PAT margin (%)

19.3

17.5

179bp

18.0

131bps

18.1

18.0

13bp

Source: Company, Angel Research, Note-FY2016 is 12month results for meaningful comparison, From FY2017, company has March ending company

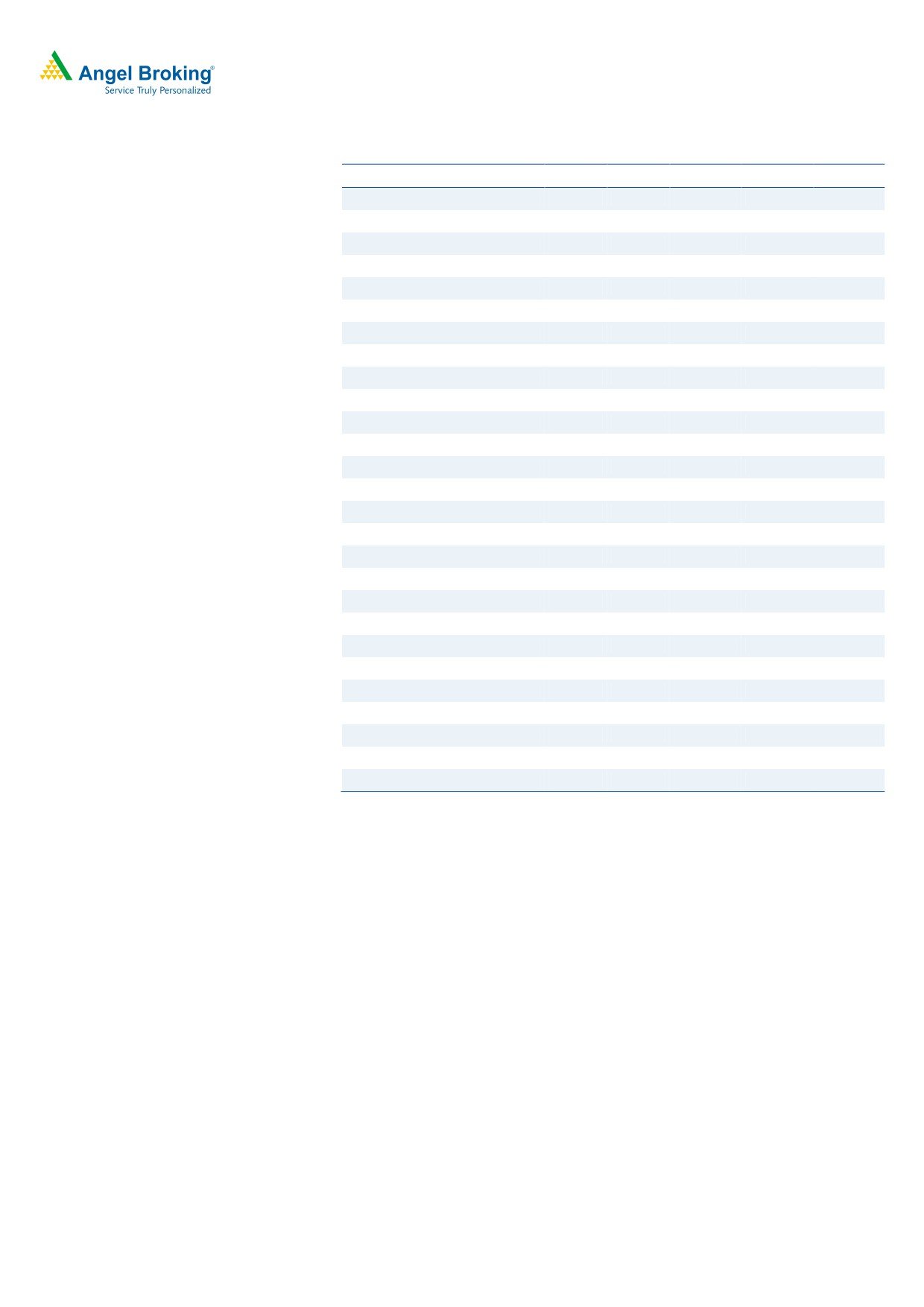

Exhibit 2: 4QFY2017 - Actual Vs Angel estimates

(` cr)

Actual

Estimate

Variation (%)

Net revenue

12,053

12,064

(0.1)

EBIDTA margin (%)

22.0

21.9

59bp

PAT

2,325

1,982

17.3

Source: Company, Angel Research

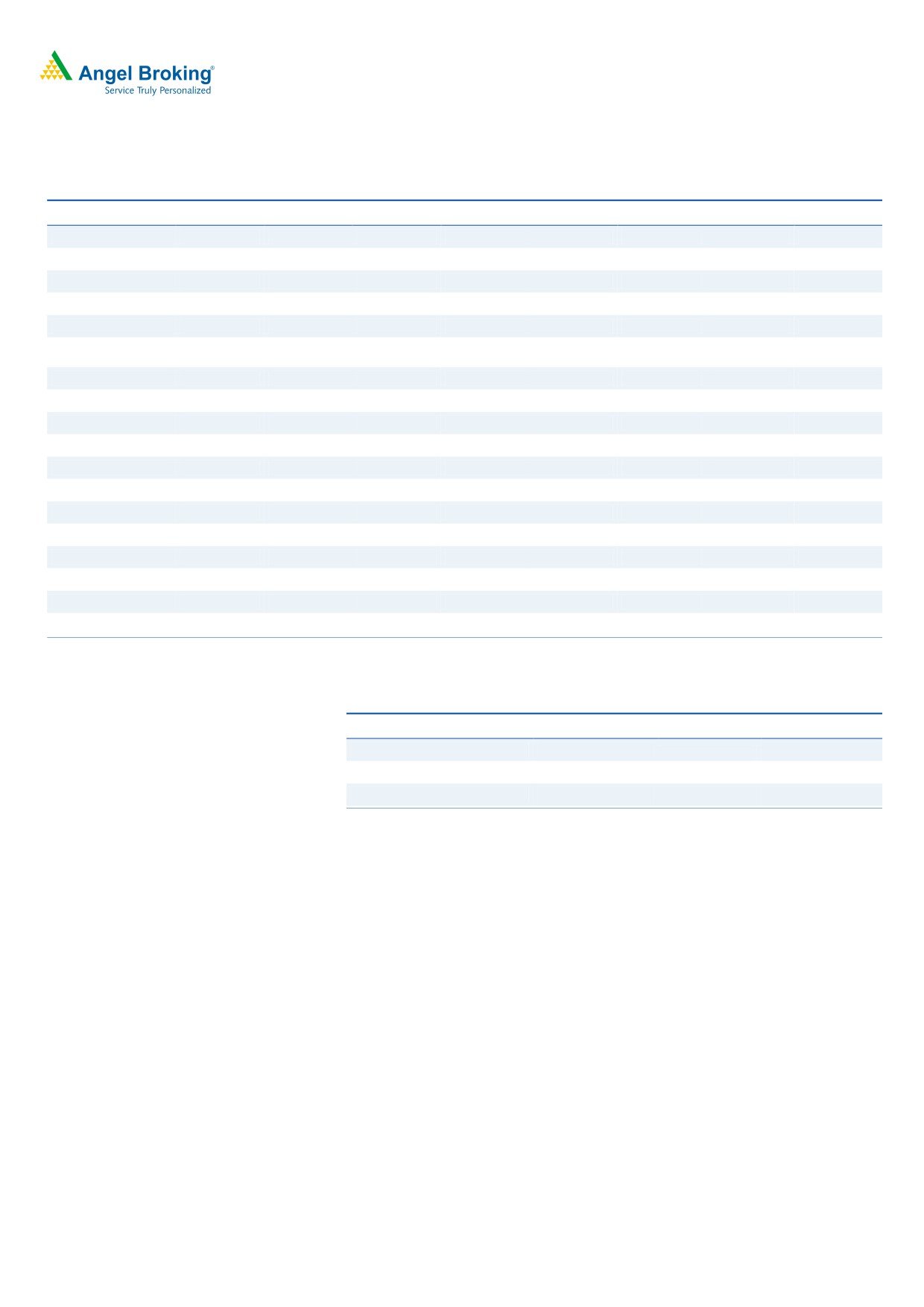

Sales just in-line with expectation

On the revenue front, the company posted a 4.1% sequential growth in USD

revenues to US$1,817mn (v/s US$1,810mn expected) v/s US$1,745mn in

3QFY2017. Revenue in Constant Currency (CC) was up 3.8% qoq. In Rupee

terms, revenues came in at `12,053cr (v/s `12,064cr expected) v/s `11,814cr in

3QFY2017, up 2.0% qoq.

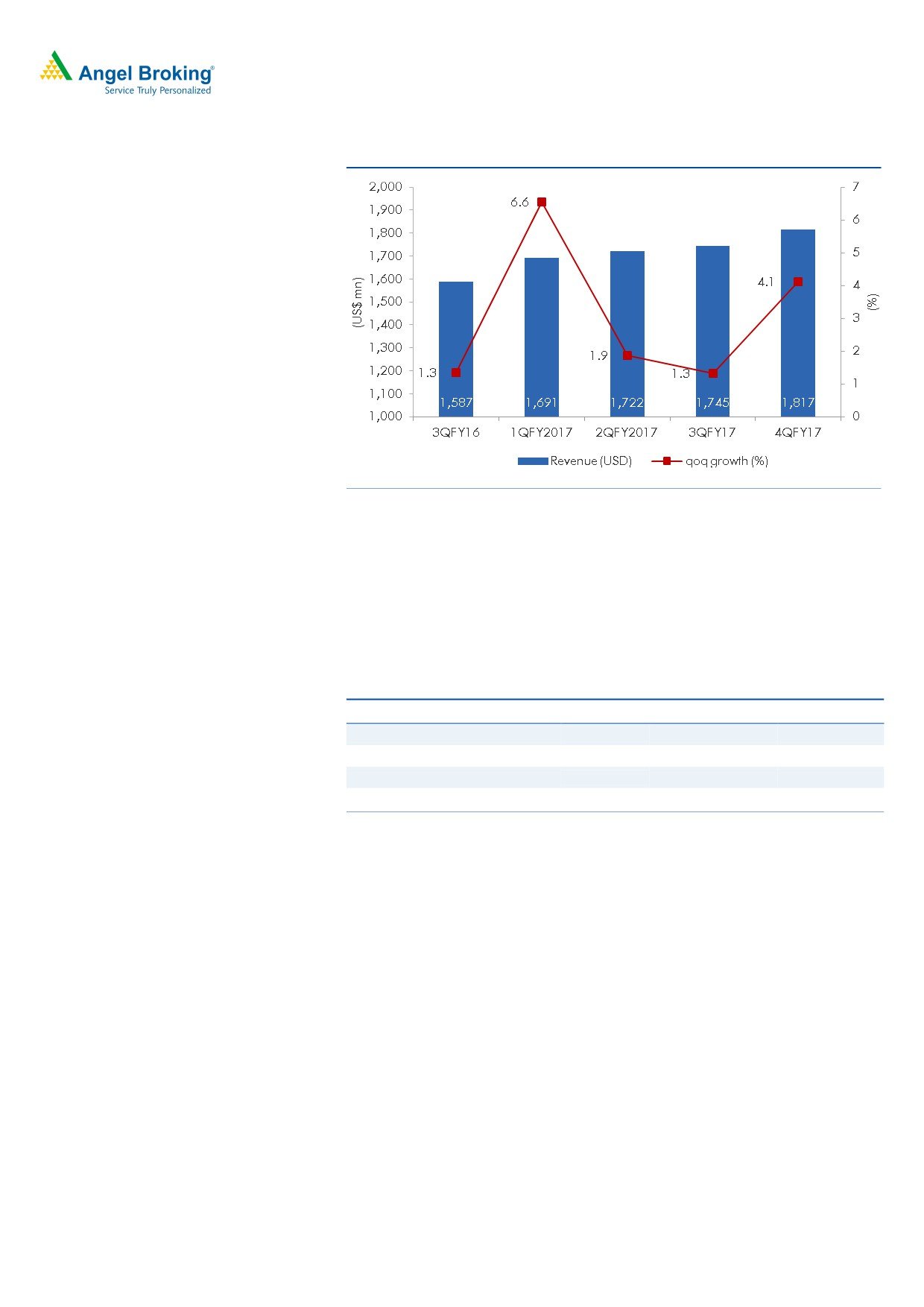

On the growth front, USA posted a CC qoq growth of 5.3%, Europe posted a dip

of 3.0% CC and ROW posted a CC qoq growth of 15.8%. In terms of verticals, the

Financial Services posted a CC qoq growth of 3.0%, Manufacturing posted a CC

qoq growth of 6.3%, Life sciences & Healthcare posted a CC qoq growth of 0.1%,

Public Services posted a CC qoq growth of 8.1%, while Retail & CPG posted a CC

qoq growth of 2.1%. The vertical which posted a dip was Telecommunication,

Media, and Publishing & Entertainment which came in at 2.1%.

May 15, 2017

2

HCL Technologies | 4QFY2017 Result Update

Exhibit 3: Revenue growth trend

Source: Company, Angel Research

In terms of services, Engineering & R&D services (which constituted 20.5% of sales)

posted a growth of 14.6% qoq (CC), while Application services (accounting for

36.8% of sales) grew by 1.8% qoq (CC). Infrastructure services, another important

segment of the company, which contributes around 38.8% to overall sales, posted

a growth of 0.9% qoq (CC). Business services, which constituted 3.9% of sales,

grew by 0.2% qoq (CC).

Exhibit 4: Revenue growth trend (Service wise)

% of revenue

% growth CC (qoq)

% growth (yoy)

Application services

36.8

1.8

7.2

Infrastructure services

38.8

0.9

24.8

Business services

3.9

0.2

(11.7)

Engineering and R&D services

20.5

14.6

26.0

Source: Company, Angel Research

Industry segment wise, the company’s Financial Services vertical (contributing

24.2% to revenue) posted a 3% qoq growth in CC terms. The Manufacturing

vertical (contributing 34.6% to revenue) posted a 6.3% qoq growth in CC terms.

Public services, Life sciences & Healthcare, and Telecommunication, Media,

Publishing & Entertainment reported a qoq growth of 8.1%, 2.1% and (2.1)%, all in

CC terms, respectively. Retail & CPG (contributing 9.2% of the revenue), on the

other hand, reported a growth of 2.1% qoq CC terms, during the quarter.

May 15, 2017

3

HCL Technologies | 4QFY2017 Result Update

Exhibit 5: Revenue growth trend (Industry wise)

% of revenue

% growth (CC qoq)

% growth (yoy)

Financial services

24.2

3.0

13.4

Manufacturing

34.6

6.3

27.4

Life sciences & Healthcare

11.5

0.1

3.5

Public Services

11.7

8.1

22.4

Retail & CPG

9.2

2.1

17.2

Telecom, MPE

8.4

(2.1)

(2.6)

Source: Company, Angel Research

Among geographies, in CC terms, America grew by 5.3% qoq, RoW grew by

15.8% qoq, while Europe de-grew by 3.0% qoq, during the period.

Exhibit 6: Revenue growth trend (Geography wise in CC terms)

Source: Company, Angel Research

Hiring and utilization

During the quarter, the overall headcount of HCL Tech increased by 10,426 to

1,15,973 employees. The attrition rate in IT Services inched downwards to 16.9%

(v/s 17.9% in 3QFY2017) and the blended utilization level of the company inched

up to 85.7% (v/s 84.6% in 3QFY2017).

Exhibit 7: Hiring trend

Particulars

3QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Technical

95,649

98,225

99,897

1,01,154

1,05,547

Support

9,247

9,743

9,898

9,938

10,426

Total employee base

104,896

107,968

109,795

1,11,092

1,15,973

Gross addition

9,280

10,515

9,083

8,467

10,605

Net addition

1,200

3.072

2,097

3,124

6,178

Attrition - IT services (LTM) - %

17.3

17.8

18.6

17.9

16.9

Source: Company, Angel Research

May 15, 2017

4

HCL Technologies | 4QFY2017 Result Update

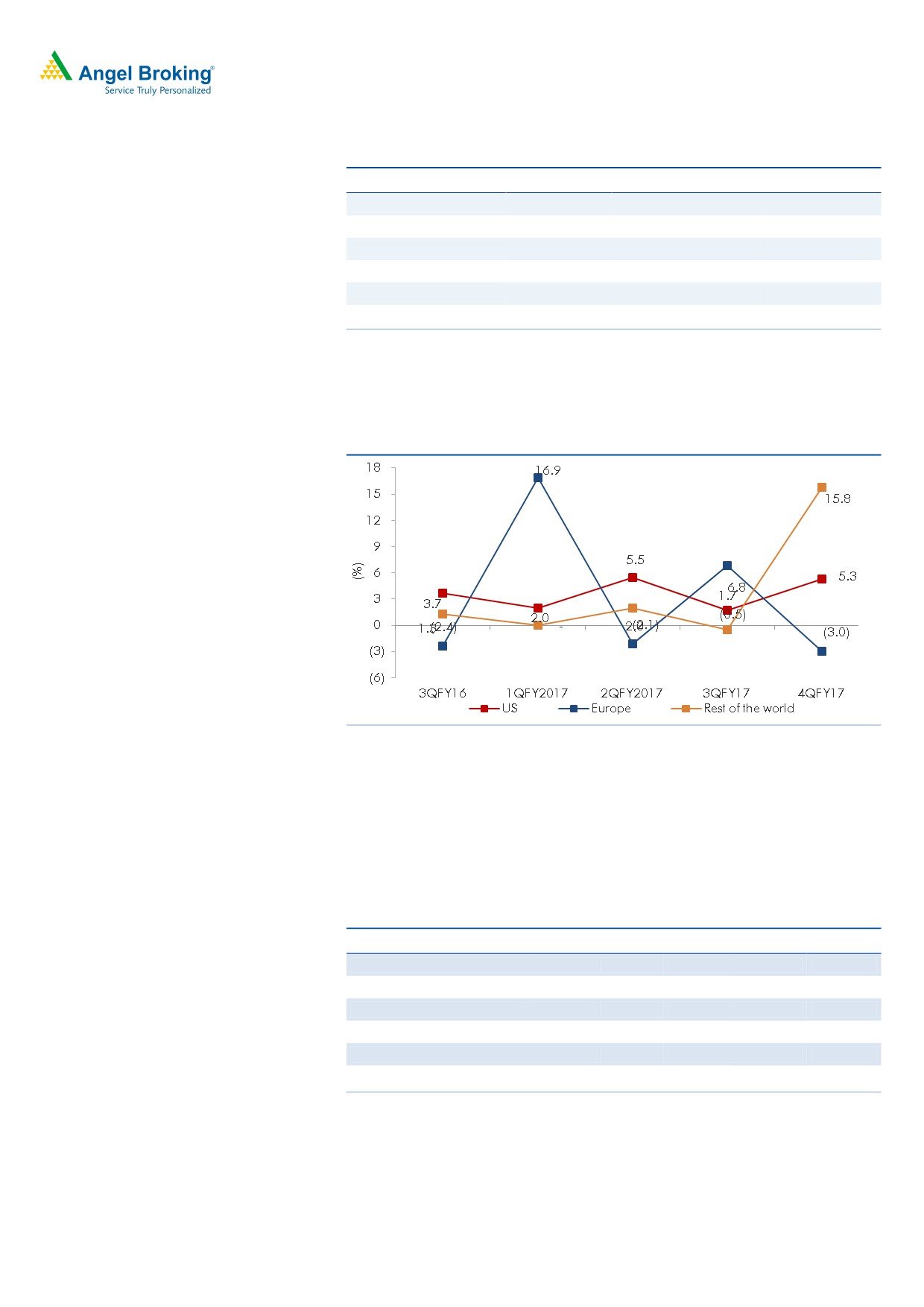

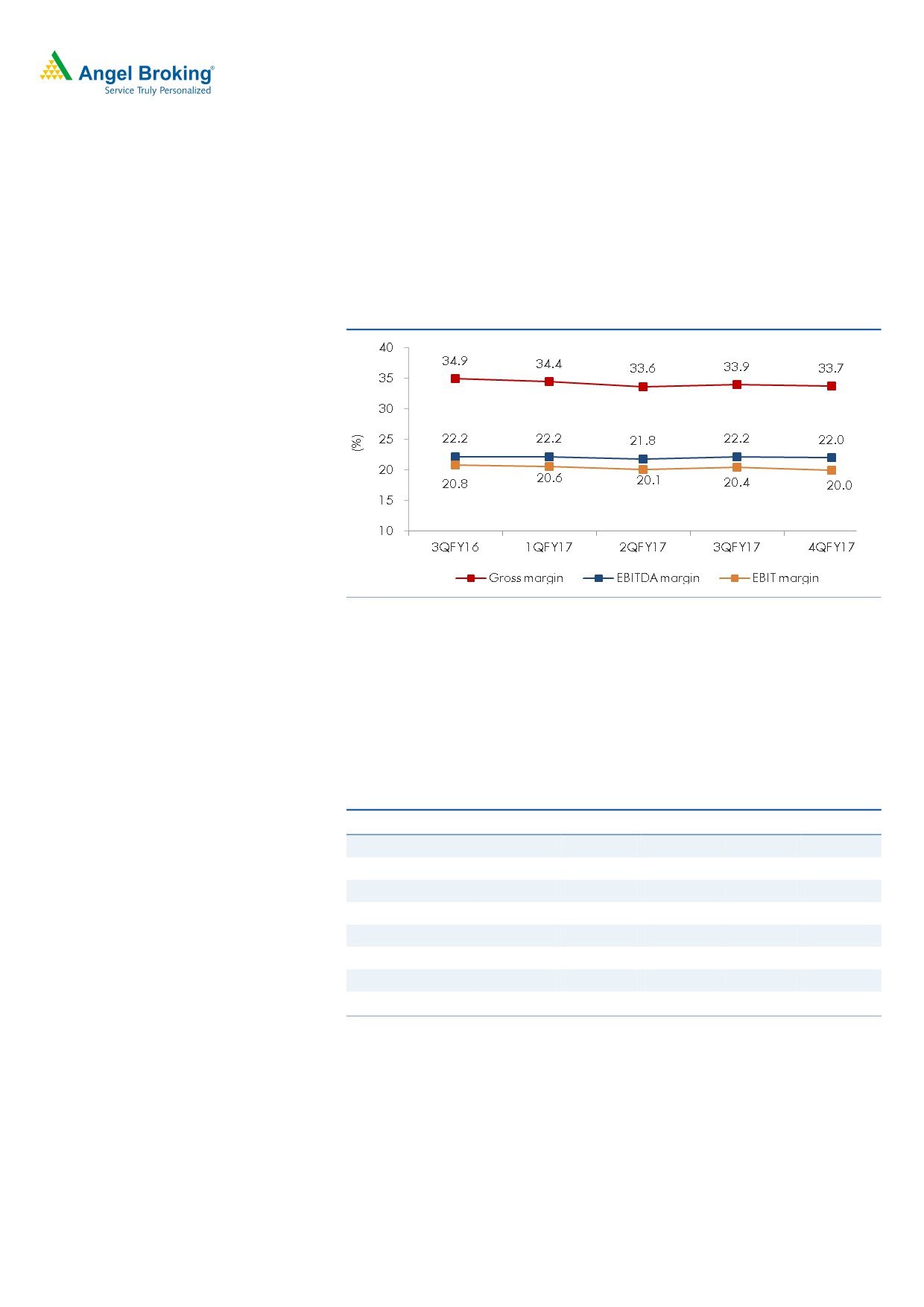

Operating margin just in line with the expectation

On the operating front, the EBDITA margins came in at 22.0% (v/s 22.2% in

3QFY2017), a qoq dip of 27bp, while the EBIT margins came in at 20.0%, a qoq

dip of 34bp. This was against the EBDITA & EBIT margin expectations of 21.9% &

20.1% respectively.

Exhibit 8: Margin profile

Source: Company, Angel Research

Client pyramid

The company signed

8 transformational deals this quarter. These deals

represented a well-balanced mix across service lines, industry verticals and

geographies. This takes the total number of transformational wins to 42 for

FY’2017. Company added 5 clients in the US$50+mn and 3 in the US$20+mn.

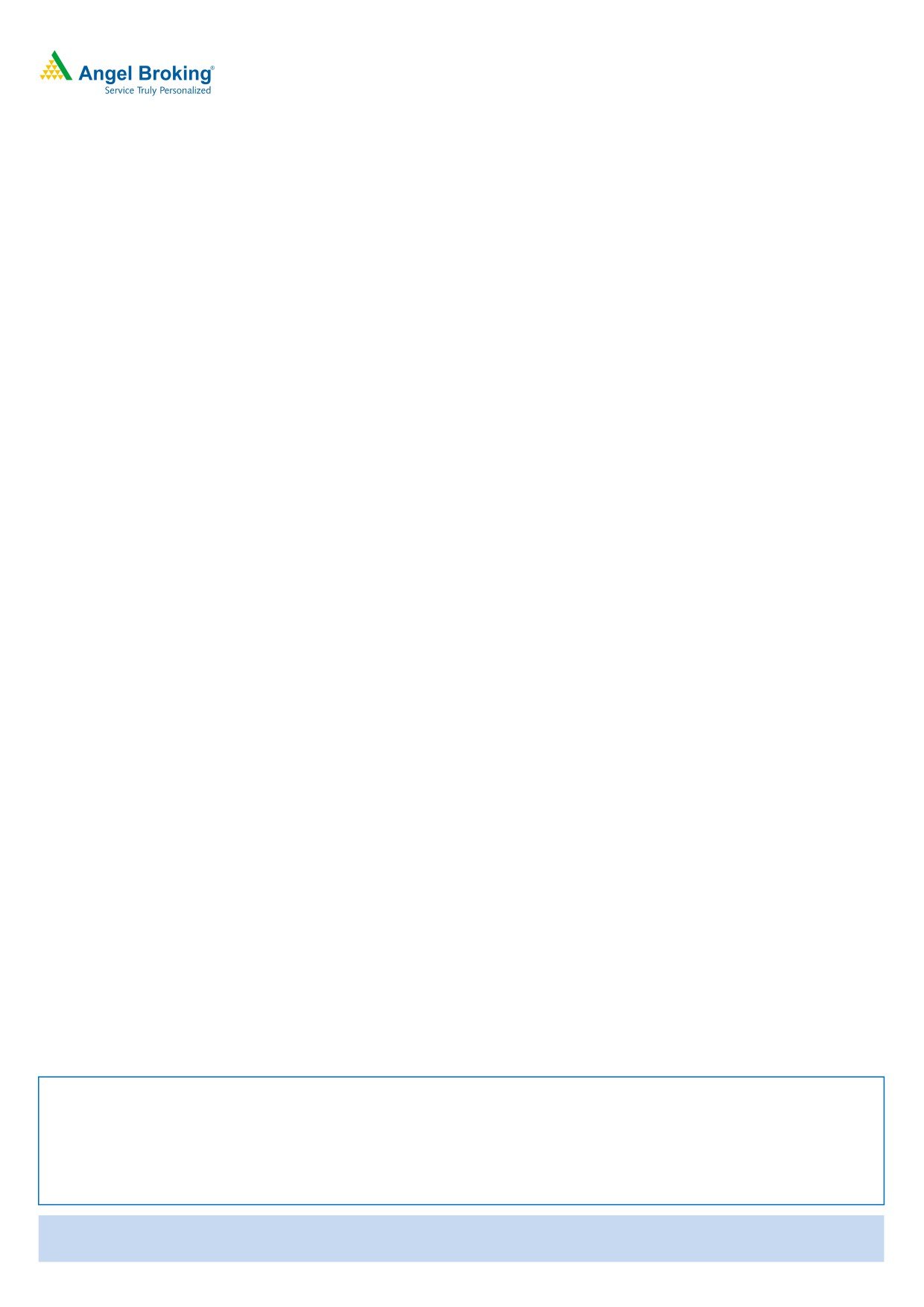

Exhibit 9: Client pyramid

Particulars

3QFY16

1QFY17

2QFY17

3QFY17

4QFY17

US$1mn-5mn

267

262

245

259

260

US$5mn-10mn

87

84

91

89

93

US$10mn-20mn

66

49

66

64

68

US$20mn-30mn

32

35

32

33

36

US$30mn-40mn

16

16

16

15

15

US$40mn-50mn

4

5

12

14

9

US$50mn-100mn

12

10

13

12

17

US$100mn plus

7

7

7

8

8

Source: Company, Angel Research

May 15, 2017

5

HCL Technologies | 4QFY2017 Result Update

Investment arguments

Robust outlook for FY2018: On the basis of deals on hand, the company gave a

revenue growth guidance of 10.5-12.5% in CC for FY2018, which includes a

component of inorganic growth, adjusting for which, the organic growth would be

7.5-9.5% in CC for FY2018. The operating margin (EBIT) for FY’2018 is expected

to be in the range of 19.5-20.5%. We expect HCL Tech to post a USD and INR

revenue CAGR of 10.7% and 10.7% respectively, over FY2017-19E (inclusive of

the acquisition of Geometric Software and Volvo deals).

Healthy pipeline: HCL Tech signed 8 transformational deals this quarter, across

service lines and industry verticals. The broad-based business wins were driven by

next-generation integrated offerings - Next-Gen ITO, BEYONDigital, and IoT

WoRKS, reflecting investments in Internet of Things, digital technologies, cloud,

automation and artificial intelligence. Company added 5 clients in the US$50+mn

and 3 in the US$20+mn. Overall, in FY2017 the company added 42 clients.

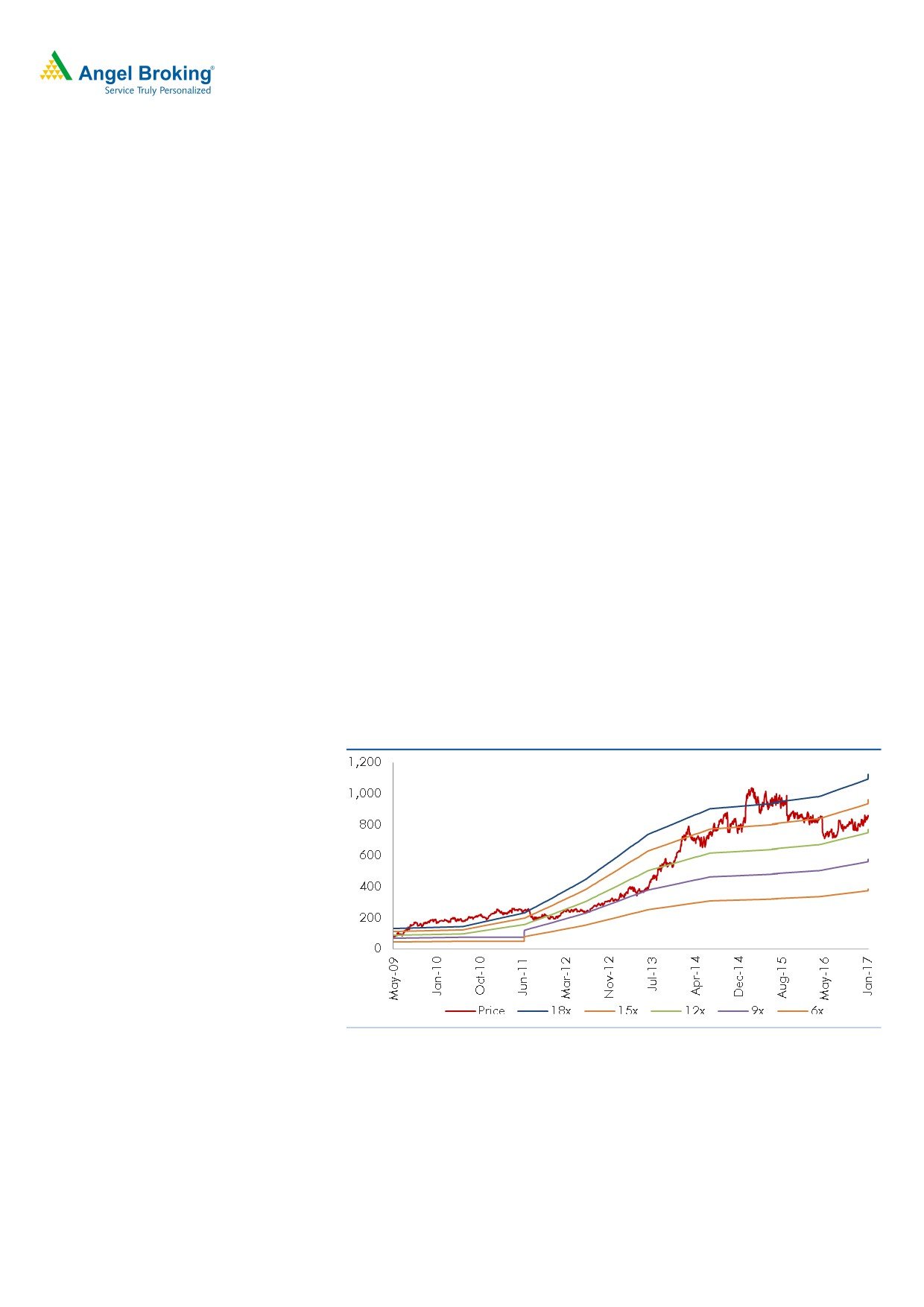

Outlook and valuation

On the operating front, HCL Tech’s EBIT margin had been around 19.3% in

FY2017, a dip of 1000bp over the previous financial year. With the acquisition of

Geometric Software and Volvo, we expect the EBIT margin to be under pressure

during FY2017. We expect the EBIT and PAT to post a 7.9% and 7.1% CAGR

respectively over FY2017-19E. At the current market price, the stock is trading at

13.5x FY2018E and 12.5x FY2019E EPS. We recommend a Buy, with a price

target of `1,014.

Exhibit 10: One-year forward PE (x) chart

Source: Company, Angel Research

May 15, 2017

6

HCL Technologies | 4QFY2017 Result Update

Exhibit 11: Recommendation summary

Company

Reco

CMP

Tgt Price

Upside

FY2018E

FY2018E

FY2016-18E

FY2018E

FY2018E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

847

1,014

19.7

20.9

13.5

3.0

2.0

22.4

Infosys

Buy

964

1,179

22.3

26.0

15.1

4.4

2.6

19.7

TCS

Accumulate

2,360

2,651

12.4

27.6

16.3

8.5

3.3

29.7

Tech Mahindra

Buy

442

600

35.7

17.0

11.1

11.4

1.0

20.7

Wipro

Accumulate

507

570

12.5

20.3

13.9

4.0

1.4

14.6

Source: Company, Angel Research

Company Background

HCL Tech is India's fifth largest IT services company, with over

1,00,000

employees catering to more than 450 clients. The company's service offerings

include Enterprise Application Services (EAS), Custom Applications, Engineering

Research & Development (ERD), and Infrastructure Management Services (IMS). In

December 2008, HCL Tech acquired UK-based SAP consulting company - Axon,

which now contributes

~10% to its consolidated revenue. Recently, during

3QFY2016, the company acquired Geometric Software.

May 15, 2017

7

HCL Technologies | 4QFY2017 Result Update

Profit and loss statement (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net sales

37,061

30,781

46,723

52,342

57,053

Cost of revenues

23,798

20,235

30,890

34,598

37,712

Gross profit

13,263

10,546

15,833

17,744

19,341

% of net sales

35.8

34.3

33.9

33.9

33.9

SG&A expenses

4,563

3,940

5,524

6,804

7,417

% of net sales

12.3

12.8

11.8

13.0

13.0

EBITDA

8,700

6,606

10,309

10,939

11,924

% of net sales

23.5

21.5

22.1

20.9

20.9

Depreciation and amort.

451

393

835

935

1085

% of net sales

1.2

1.3

1.8

1.8

1.9

EBIT

8,249

6,213

9,474

10,004

10,839

% of net sales

22.3

20.2

20.3

19.1

19.0

Other income, net

912

756

934

934

934

Profit before tax

9,161

6,969

10,408

10,938

11,773

Provision for tax

1,908

1,364

1,952

2,078

2,237

% of PBT

20.8

19.6

18.8

19.0

19.0

PAT

7,253

5,605

8,457

8,860

9,536

Share from equity invest.

-

-

-

-

-

Forex loss

-

-

-

-

-

ESOP charges

103

38

-

-

-

Reported net profit

7,253

5,643

8,457

8,860

9,536

Fully diluted EPS (`)

51.4

40.0

60.0

62.8

67.6

Note: FY2016 Numbers are 9 month figures

May 15, 2017

8

HCL Technologies | 4QFY2017 Result Update

Balance sheet (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Cash and cash equivalent

1,352

729

1,317

1,500

1,700

Account receivables, net

6,563

7,721

8,301

9,039

9,853

Unbilled receivables

2,923

3,002

2,501

3,141

3,423

Deposit with banks

9,670

10,587

10,220

14,102

20,059

Deposit (one year with HDFC ltd)

-

-

-

-

-

Invest. securities, available for sale

767

537

1,146

2,250

2,251

Other current assets

2,338

2,410

2,983

3,283

3,583

Total current assets

23,613

24,986

26,468

33,315

40,870

Property and equipment, net

3,820

4,323

4,681

4,981

5,281

Intangible assets, net

5,204

6,419

11,426

11,426

11,426

Deposits with HDFC Ltd.

-

-

-

-

-

Fixed deposits with banks

-

-

-

-

-

Investment securities HTM

8

160

147

147

147

Investment in equity investee

-

-

-

-

-

Other assets

3,066

3,879

3,712

4,780

4,780

Total assets

35,711

39,768

46,432

54,648

62,502

Current liabilities

9,232

9,509

11,148

12,483

13,606

Borrowings

469

973

542

542

542

Other liabilities

1,259

1,264

1,253

2,078

2,078

Total liabilities

10,960

11,745

12,942

15,103

16,226

Minority interest

-

-

-

-

Total stockholder equity

24,751

28,022

33,490

39,545

46,276

Total liab. and stock holder equity

35,711

39,767

46,432

54,648

62,502

Note: FY2016 Numbers are 9 month figures

May 15, 2017

9

HCL Technologies | 4QFY2017 Result Update

Cash flow statement (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

Pre tax profit from operations

7,253

5,643

8,457

8,860

9,536

Depreciation

451

393

835

935

1,085

Expenses (deffered)/written off/others

(168)

(48)

(48)

(48)

(48)

Pre tax cash from operations

7,536

5,988

9,244

9,747

10,573

Other income/prior period ad

912

756

934

934

934

Net cash from operations

8,448

6,744

10,178

10,681

11,507

Tax

(1,908)

(1,364)

(1,952)

(2,078)

(2,237)

Cash profits

6,540

5,381

8,226

8,603

9,270

(Inc)/dec in current assets

(1,991)

(1,309)

(653)

(1,677)

(1,396)

Inc/(dec) in current liabilties

1,035

277

1,639

1,335

1,123

Net trade working capital

(956)

(1,033)

987

(342)

(273)

Cashflow from operating activities

5,584

4,348

9,213

8,261

8,998

(Inc)/dec in fixed assets

(674)

(503)

(358)

(300)

(300)

(Inc)/dec in intangibles

(55)

(1,215)

(5,006)

-

-

(Inc)/dec in investments

(1,458)

(687)

(242)

(4,987)

(5,958)

(Inc)/dec in minority interest

-

-

-

-

-

Inc/(dec) in non current liabilities

(203)

5

(11)

-

-

(Inc)/dec in non current assets

(214)

(72)

(573)

(300)

(300)

Cashflow from investing activities

(2,602)

(2,473)

(6,189)

(5,587)

(6,558)

Inc/(dec) in debt

-

-

-

-

-

Inc/(dec) in equity/premium

-

-

-

-

-

ESOP charges

(103)

(103)

(103)

(103)

(103)

Dividends

(1,651)

(2,805)

(2,805)

(2,805)

(2,805)

Others

(208)

2,385

614

1,551

1,969

Cashflow from financing activities

(1,962)

(523)

(2,294)

(1,357)

(939)

Cash generated/(utilised)

331

(623)

587

184

200

Cash at start of the year

1,021

1,352

729

1,317

1,500

Cash at end of the year

1,352

729

1,317

1,500

1,700

Note: FY2016 Numbers are 9 month figures

May 15, 2017

10

HCL Technologies | 4QFY2017 Result Update

Key ratios

Y/E Mar

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation ratio (x)

P/E (on FDEPS)

16.5

21.2

14.1

13.5

12.5

P/CEPS

15.5

19.8

12.9

12.2

11.3

P/BVPS

4.8

4.3

3.6

3.0

2.6

Dividend yield (%)

1.7

2.0

2.0

2.0

2.0

EV/Sales

3.0

3.6

2.3

2.0

1.7

EV/EBITDA

12.6

16.6

10.5

9.5

8.2

EV/Total assets

3.1

2.8

2.3

1.9

1.6

Per share data (`)

EPS (Fully diluted)

51.4

40.0

60.0

62.8

67.6

Cash EPS

54.6

42.8

65.9

69.4

75.3

Dividend

14.0

17.0

17.0

17.0

17.0

Book value

175

199

237

280

328

Dupont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.1

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.2

0.2

0.2

0.2

0.2

Asset turnover ratio (Sales/Assets)

1.0

0.8

1.0

1.0

0.9

Leverage ratio (Assets/Equity)

1.4

1.4

1.4

1.4

1.4

Operating ROE

29.3

20.0

25.3

22.4

20.6

Return ratios (%)

RoCE (pre-tax)

23.1

15.6

20.4

18.3

17.3

Angel RoIC

34.5

22.4

28.2

27.3

28.3

RoE

29.3

20.1

25.3

22.4

20.6

Turnover ratios (x)

Asset turnover (fixed assets)

10.6

7.6

10.4

10.8

11.1

Receivables days

68

83

78

67

66

Note: FY2016 Numbers are 9 month figures

May 15, 2017

11

HCL Technologies | 4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

HCL Technologies

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)